The future of fundraising belongs to platforms that blend technology, compliance, and investor experience into a single, seamless process. With Dalmore Portal, issuers aren’t just getting software, they’re getting the same infrastructure trusted by some of the largest and most innovative capital-raising platforms in the country.

In the modern capital markets, the line between fintech, e-commerce, and compliance technology is blurring fast. At Dalmore Technology, we’ve built our white-label fundraising portal to live at that intersection, combining the best of investor experience, compliance oversight, and operational efficiency in one platform.

For issuers, this means more conversions, more transparency, and less friction.

For investors, it means simpler transactions, faster approvals, and more confidence in every offering.

Here’s an inside look at the features that make our portal the most robust, compliant, and scalable in the industry.

5-Minute Checkout with Conversion-First Design

Investor onboarding takes less than five minutes, start to finish. We’ve engineered the process to prioritize conversion — blending e-commerce speed with financial compliance:

The result? Higher completion rates, lower abandonment, and an investor experience that feels like buying a product online — but with broker-dealer compliance built in.

Transparent Investor Review Process

One of the biggest investor pain points is the uncertainty between submitting an investment and getting approved.

Our portal eliminates that:

This transparency increases trust, speeds up approvals, and reduces inbound support requests.

Pixel Tracking & Conversion Analytics

We give issuers the same kind of marketing insights top e-commerce brands use to track marketing performance. No longer will paid ads result in fragmented analytics as issuers can leverage:

These insights empower marketing teams to optimize ad spend and target follow-ups with precision.

Abandoned Cart & Strategic Email Follow-Up

If an investor starts the process but doesn’t finish, the portal automatically triggers abandoned cart emails to ensure interested investors are aware of the process and progress of their transaction.

This feature alone has a measurable impact on increasing capital raised.

Secondary Trading Integration

We’ve partnered with Alternative Trading Systems (ATS) to allow issuers to enable potential liquidity for investors with transaction activity visible directly from the same portal where they invested.

Data Room & Investor Communications

The portal isn’t just a transaction engine — it’s an investor relationship hub:

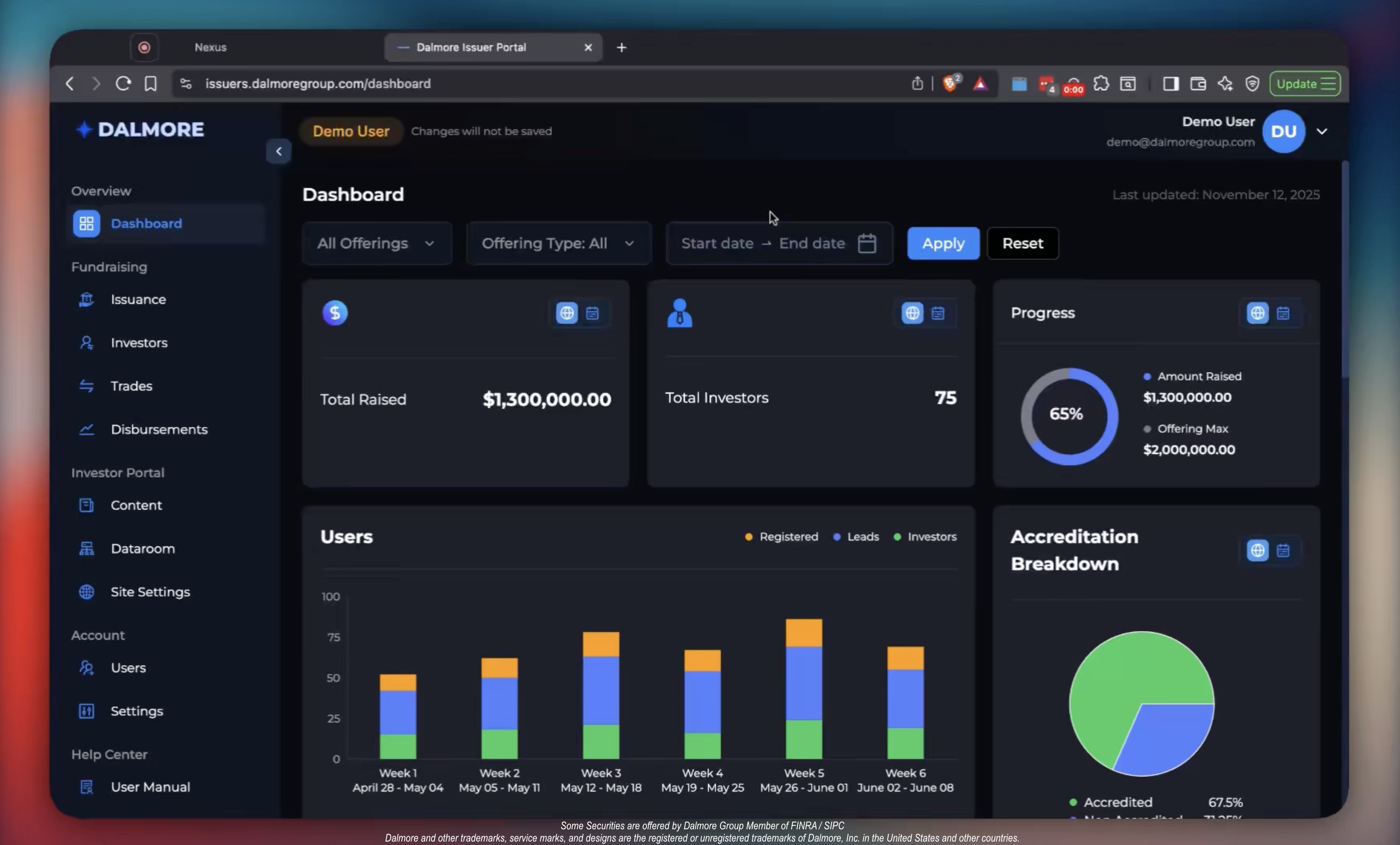

Why This Matters for Issuers

Our technology was built to remove the friction that slows down issuers: fragmented systems, manual investor reviews, and disconnected payment flows. Every piece of the portal from multi-asset checkout to real-time compliance review, was designed to help you launch faster, convert more investors, and stay compliant without losing control of your brand.

In 2024 alone, issuers supported by Dalmore Group raised more than $750 million, with ongoing monthly raises between $30 million and $60 million. But beyond the numbers, the real success is what that represents: founders, fund managers, and platforms who no longer have to choose between compliance and growth.

Securities offered by Dalmore Group LLC. Member FINRA/SIPC