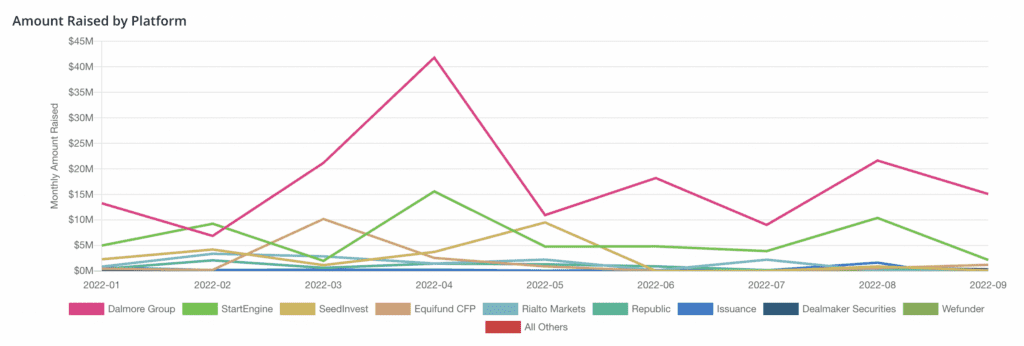

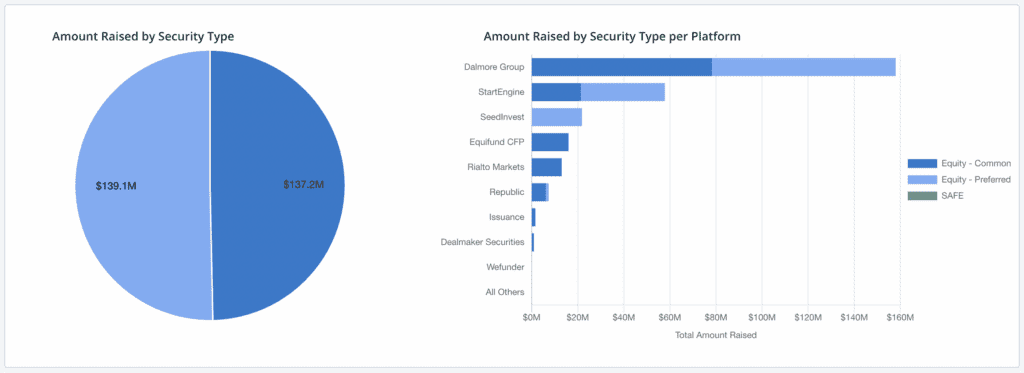

More than 50% of all Regulation A+ raises tracked by KingsCrowd came from Dalmore.

NEW YORK, NY. October 2022. Dalmore Group, the go-to Broker-Dealer for Regulation A+ financing, is number one in Regulation A+ offerings as reported by KingsCrowd, the online private market’s first and most trusted data and analytics platform. Dalmore Group accounts for more than 50% of all Regulation A+ raises tracked by KingsCrowd, as well as over 50% that have opened this year alone.

“It is always exciting when our peers recognize Dalmore’s industry prominence. Having just recently exceeded one million Regulation A+ investments and one hundred thousand Regulation A+ secondary trades, Dalmore has done an amazing job capitalizing on incredible industry growth for our clients,” shares Etan Butler, Dalmore Group Chairman. “Not only are we heads above our industry peers in terms of total amount raised, Dalmore’s unique boutique- approach to funding is also a fraction of the cost of competitors, making us not only the most valuable partner, but also the most valued.”

KingsCrowd founder and CEO, Chris Lustrino adds, “Since KingsCrowd started collecting data in 2018, online equity crowdfunding deal volume has seen a triple-digit increase. However, we also know that not all Broker-Dealers provide the same level of service for their client base to truly capitalize on these opportunities. However, based on Dalmore’s performance in the first half of this year, it is clear that the service, industry know-how, and critical connections that they offer clients give them all an acute advantage and lead to more successful raises than their competitor set.”

Dalmore group has onboarded more than 250 Regulation A+ clients and currently has more than $3.6B in current investment offerings. With a pipeline of more than $4B in new deals and an industry-leading 50+ fractional share platform clients for whom it provides customized primary issuance and secondary market trading services, it is clear that no one can top Dalmore’s level of industry success.

This growth comes at a critical time as founders eye the future of funding with some uncertainty. Butler understands these concerns, adding “there is a sentiment among founders that venture capitalists are unfairly punishing startups for the outsized valuations of the past few years. This is creating a groundswell of founders looking for alternative ways to fund their businesses — which presents a great opportunity for online investors to capitalize on some potentially extraordinary deals that previously might not have been available.”

The pandemic increased exposure to and awareness of online investing. Over the last two years, millions of people flocked to investing through apps like Robinhood and M1, and that interest carried over to various new markets, including collectibles, cryptocurrency, and fractional real estate investments. It is thanks to these small behavioral changes that have allowed crowdfund investing to finally reach mass market awareness.

“Of course, as we look at the current economic headwinds, we recognize that online startup investing may slow in the coming months,” stated Butler. “However, the bullish outlook would suggest that once investors regain confidence, they will absolutely be more inclined to invest in private deals. Once markets rebound and people build their financial security, the investing climate will be at the perfect inflection point given reset valuations and technical tools like KingsCrowd enabling access to more deals than ever before.”

This is why it is imperative for founders to explore Dalmore’s offerings today. Dalmore is the Broker-Dealer poised to help more and more companies raise capital online at scale through Regulations A+, CF, and D.

Contact Dalmore for more information at www.dalmorefg.com.

ABOUT DALMORE

Dalmore Group specializes in helping companies raise capital online at scale through Regulations A+, CF and D, and has onboarded over 250 Regulation A+ issuers since 2019. Learn more about how Dalmore Group is leading the way for primary issuance and secondary market trading of private securities at dalmorefg.com and keep up to date on the latest company news with Dalmore Group’s LinkedIn, Facebook, and Twitter accounts.

ABOUT KINGSCROWD

KingsCrowd was founded in 2018, just two years after online startup investing became legal. KingsCrowd’s mission is to empower investors of all backgrounds to make informed, data-driven investment decisions. To fulfill that goal, KingsCrowd provides educational resources, discovery tools, and both qualitative and quantitative ratings on equity-based startup investment opportunities. All of these tools and services combine to give investors actionable and data-driven insights for online startup investing. KingsCrowd also uses its detailed database to track and provide market-level analysis of online startup investing. KingsCrowd ensures that investors never miss out on promising private market investments while eliminating hours of work spent searching for and vetting deals. For more information, visit KingsCrowd at kingscrowd.com, LinkedIn, or Twitter.