MEDIA / PRESS

From Accredited Investors to Retail Backers: How a Broker Dealer Broadens Your Capital-Raising Potential

Introduction:In the world of capital raising, investors can vary—from seasoned accredited investors to emerging retail backers looking to diversify their portfolios. Traditionally, fundraising strategies catered

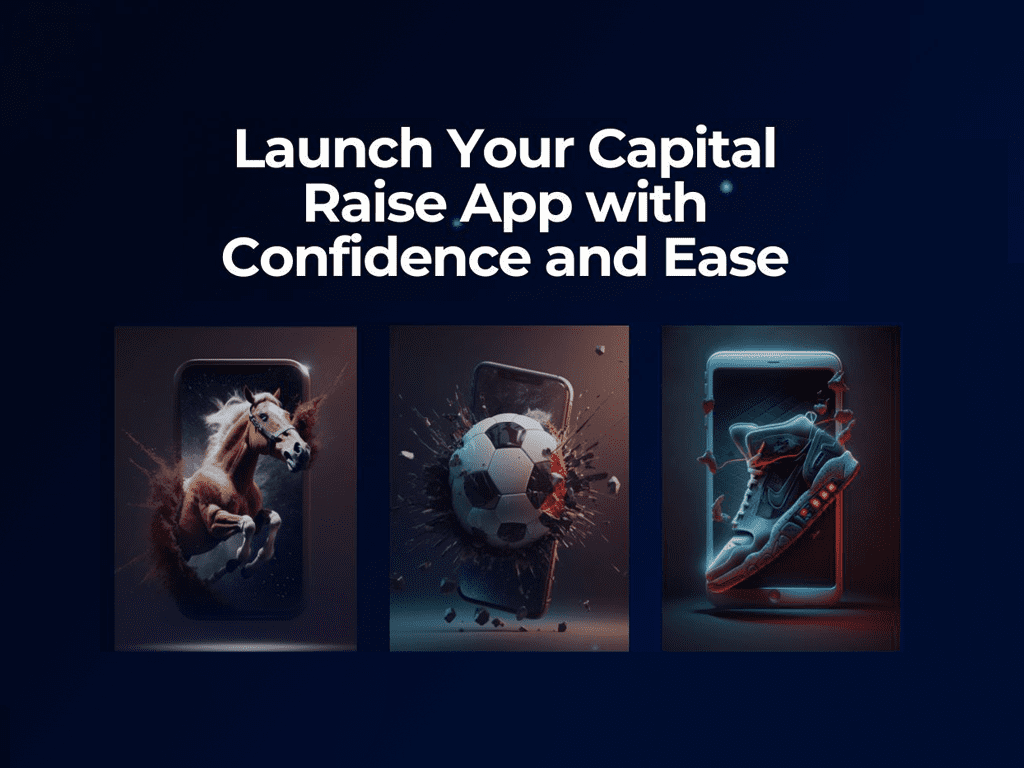

The Future of Capital Raising: How Reg A Enables Easier Online Fundraising and Opens Up Capital from Non-Accredited Investors

The world of capital raising is evolving rapidly. With the rise of digital platforms and the democratization of investment opportunities, companies are no longer confined

Breaking Free from Traditional Fundraising

How to Supercharge Your Reg D Raise with a Regulatory Compliant Sales Force For many fund managers, traditional capital-raising strategies have always been the go-to

Dalmore Group and FINRA: Ensuring Compliance and Trust in the Crowdfunding Industry

When it comes to equity crowdfunding and capital raising, regulatory compliance is key to building trust and credibility with investors. Dalmore Group, a leader in

Unveiling the Power of Regulation CF: Opportunities for Issuers and Investors

In the evolving landscape of capital raising, Regulation Crowdfunding (Reg CF) stands out as a beacon for startups and investors alike. Introduced to democratize access

Mastering 2024’s Capital Raising Landscape: Strategies to Triumph Over Emerging Challenges and Secure Success

As we step towards 2024, the capital-raising landscape is poised for significant transformation. In this rapidly evolving environment, selecting the right technology and broker-dealer partner

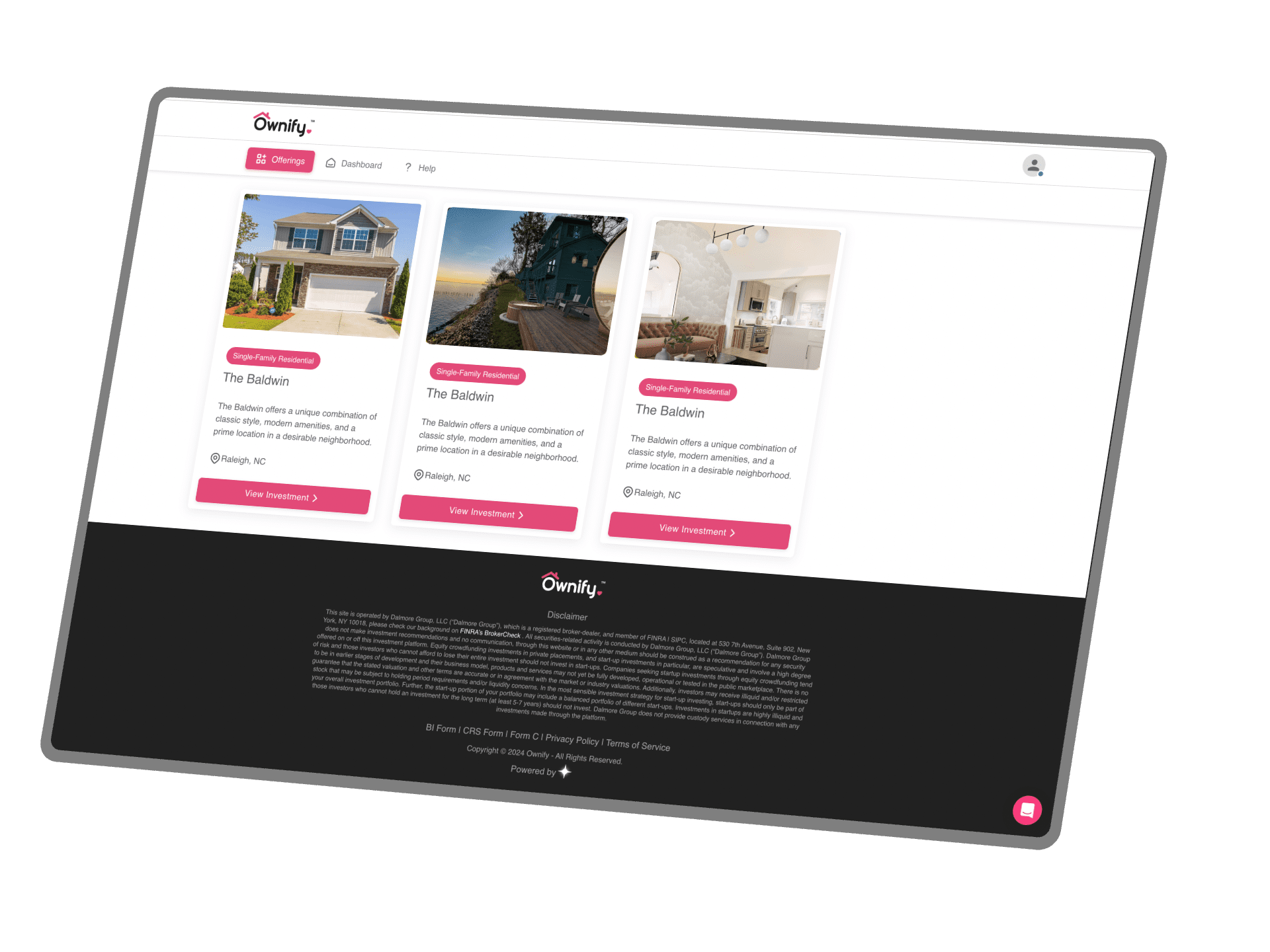

Fractional Fusion: Unlocking Ownership Opportunities, One Slice at a Time

In a rapidly evolving financial landscape, where access to investment opportunities is becoming more democratized than ever, fractional investing has emerged as a compelling trend

3 Key Steps to Cultivate a Thriving Investor Community and Supercharge Your Capital Raise

While a robust pitch and a compelling business plan are undoubtedly essential, don’t overlook the power of building an engaged investor community. A supportive group

Try Our New Capital Raise Calculator

We are thrilled to announce the release of our innovative crowdfunding calculator tool, unveiled recently at the Reg A conference. This cutting-edge tool is designed

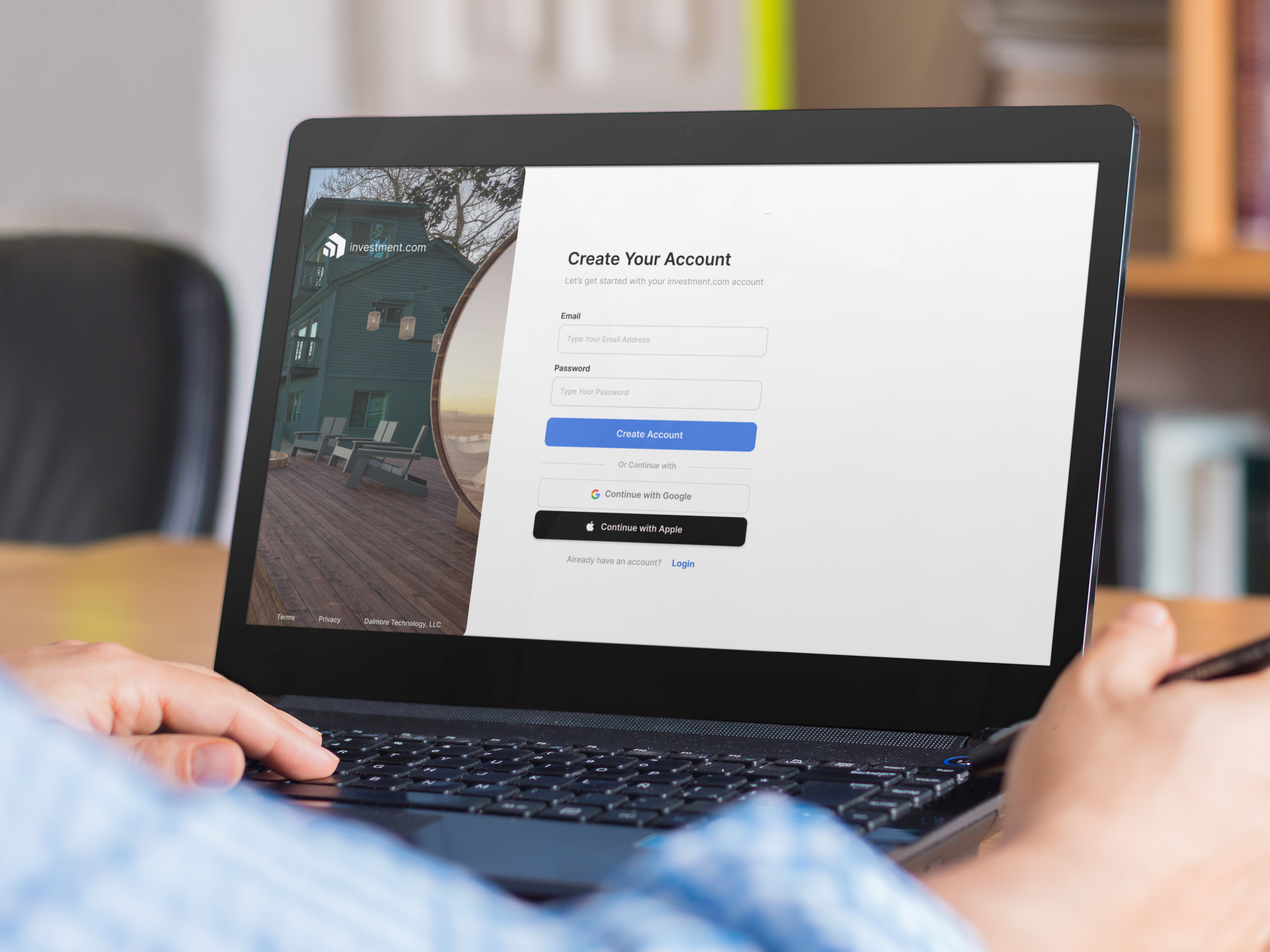

The Importance of Single Sign-On for Web and App Applications: A Boost to Conversions and User Experience

Technology has redefined our lives in many ways, not the least of which is how we manage our digital identities. As Dalmore is consistently on

Unraveling the Crucial Role of a Regulation A Broker Dealer

As the financial landscape continually evolves, understanding the intricate roles that different entities play is crucial. Today, we delve into the world of Regulation A

The Importance of Link by Stripe in the Investment Checkout Process: A Potential Game-Changer for Dalmore Clients

Takes less than 2 seconds to invest using Link by Stripe on the checkout screen. Watch our live example. As one of the leading forces

The Future is Fractional

Early trailblazers in the realms of real estate, art, music, unique collectibles, fine wine, and various other alternative assets have been fractionalizing high-value assets. By

A Cinderella Story: The Kentucky Derby Winner, Mage, and the Power of Fractional Ownership

The 149th Kentucky Derby has come and gone, but the story behind the winner, Mage, continues to capture the imagination of horse racing enthusiasts and

Fractional Investments and Crowdfunding: How Technology is Transforming the Landscape

Fractional investments and crowdfunding have emerged as powerful tools to democratize access to investment opportunities, enabling more individuals to participate in the financial markets. The

Dalmore Group – Powered by Etan Butler

Etan Butler is the charismatic Chair of Dalmore Group, a FINRA registered national Broker Dealer Investment Bank, founded in 2005. Along with his leadership team,

Leveraging Your Customers to Make Your Reg A+ or Reg CF Campaign a Success

Promoting and marketing your Reg A+ or Reg CF is a critical part of your capital-raise campaign. As with all marketing efforts, the challenges of

Dalmore Group is #1 in Regulation A+ Offerings as Reported by KingsCrowd

More than 50% of all Regulation A+ raises tracked by KingsCrowd came from Dalmore. NEW YORK, NY. October 2022. Dalmore Group, the go-to Broker-Dealer for