Selling shares of a business to the general public may be the most traditional and direct route for companies to raise capital. It’s also the means with which most investors may be familiar, and there are several ways to go about it, from equity crowdfunding to initial public offering.

But there’s another entrepreneurial path to raising capital. This one’s a bit more unique and relatively new: fractionalizing assets that are eventually sold on the market or deployed to seek a sustained level of capital returns.

What we’re describing here are Reg A+ Series “fractionalized ownership” issuances. It’s an emerging opportunity in the equity crowdfunding space that not many businesses or investors are aware of. Yet, it truly breaks open an exciting set of new investment alternatives that were previously inaccessible to most retail investors in the regulated securities space.

What might fractionalized assets look like?

It can vary quite a bit, but here are just a few examples.

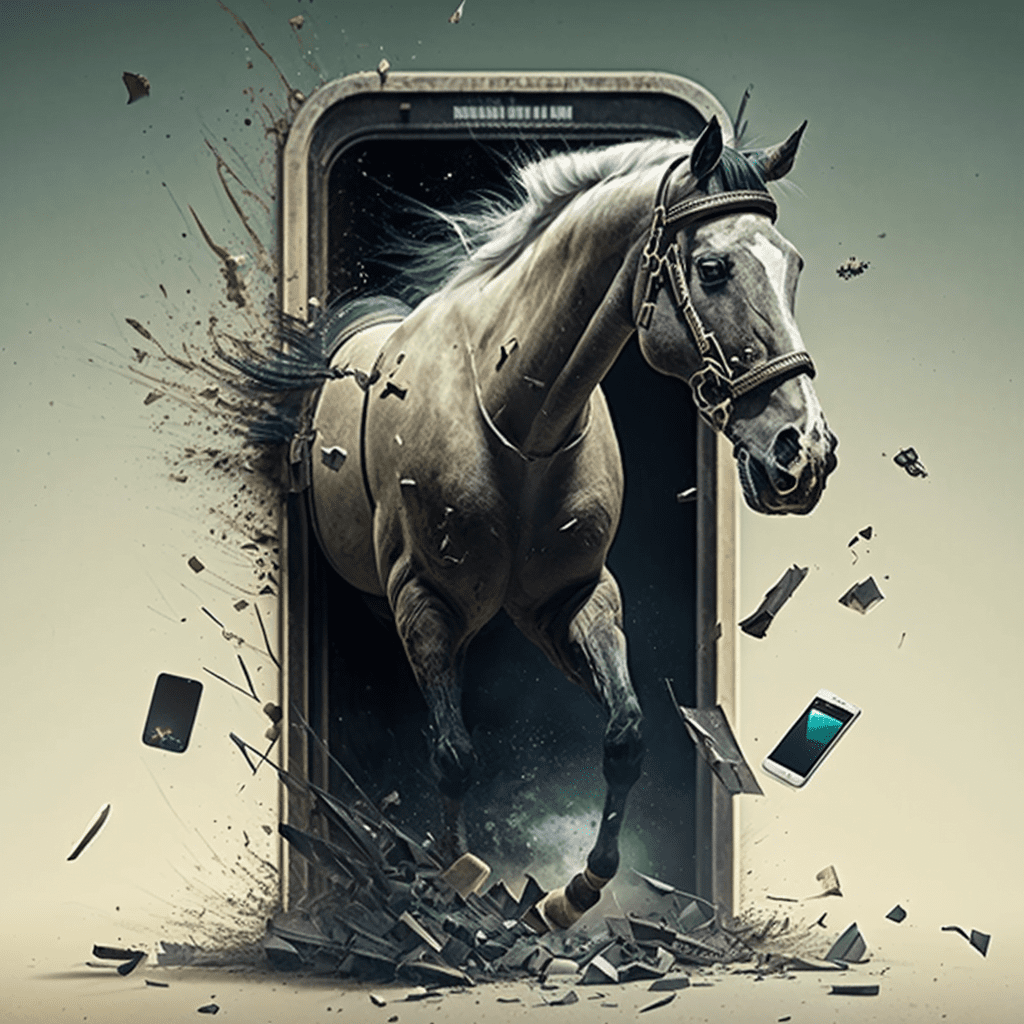

An entrepreneur who purchases and manages racehorses provides retail investors a rare opportunity to fractionally own any horse of their choosing. Investment proceeds are subject to the performance of each horse.

A company specializing in wine collections offers shares of each bundle, allowing people to participate in the proceeds of each sale.

A real estate business raises capital on a fractionalized basis from retail investors to purchase rental homes. Each investor is paid a dividend on a pro-rata basis for the shares of homes they fractionally own.

An art collector crowdfunds the purchase of expensive pieces of art, giving investors fractional shares of single pieces. Proceeds from sales will be disbursed on a pro-rata basis.

In actuality, the possibilities go far beyond these examples. They can include rare collectibles, NFTs, sports memorabilia, sneakers, magazines, art, wine, watches, race horses, vintage cars, films, and even dinosaur bones.

The scope of this opportunity is only limited by the creativity of the offerors.

Reg A+ Series issuers provide access to investments that were once the sole domain of the super-rich

Not every retail investor has, say, an extra $100,000 laying around to invest in a painting, rare collectible, rental property, or what have you. But most have $10 or more.

And if regular investors are faced with the opportunity to partially own prized assets that aren’t typically available in the traditional investment category, some may find it to be a unique and potential return source that can add even more diversification to their investment strategy.

In short, average investors can get a piece of a prize that was once only available to the super-wealthy.

And this emerging opportunity to purchase-bite sized shares of previously inaccessible assets has led to an explosion of shareholders and a rapidly growing marketplace for these private securities.

You can also trade your shares on a secondary market

Once investors purchase shares of an asset, they are not necessarily stuck with those shares. Depending on the offeror and platform, you may be able to sell your shares on a secondary market for a profit or loss (supposing you want to go to cash to pursue another opportunity).

In other words, you’re not stuck with your shares until their final disbursement. You have the option to close out of your position when you think it’s most advantageous to do so, provided there is adequate demand for your shares.

How might I benefit from becoming a Reg A+ series issuer?

If the purchase and sales of prized assets fit within your business structure, then crowdfunding a portion of your assets might help increase your capacity or asset portfolio.

Reg A+ allows you to raise up to $75 million in capital within a given year. That can give you ample time and opportunity to raise capital from your customers and any retail investors that may be interested in your offering.

How can I get started?

The concept may seem relatively simple, but there are numerous steps to take that might get slightly confusing to those entering this space for the first time. It helps to consult a Broker-Dealer (BD) specializing in the Reg A+ Series (fractional ownership) issuer space. And currently, that title belongs to the Dalmore Group.

Dalmore has guided several big-name companies toward becoming series issuers, including Rally Road, Collectable, Otis Wealth, MyRacehorse, Arrived Homes, Ark7, and many others. Dalmore has also helped these companies build secondary trading solutions for their investors. Having onboarded over 200 Reg A+ clients since 2019, Dalmore has become the go-to BD for issuers seeking solid guidance in this growing marketplace.

Fractionalizing prized assets into shares that can be traded on a secondary market or held for potential returns is like building a small investment ecosystem. You’re assembling a portfolio of products by raising capital in exchange for shares of ownership in a market that may contribute to the diversification goals of your customers and the investing public at large.

The Dalmore Group can guide you toward making the best of your capital raise campaign and offering.